The European Factoring Market met in Cologne

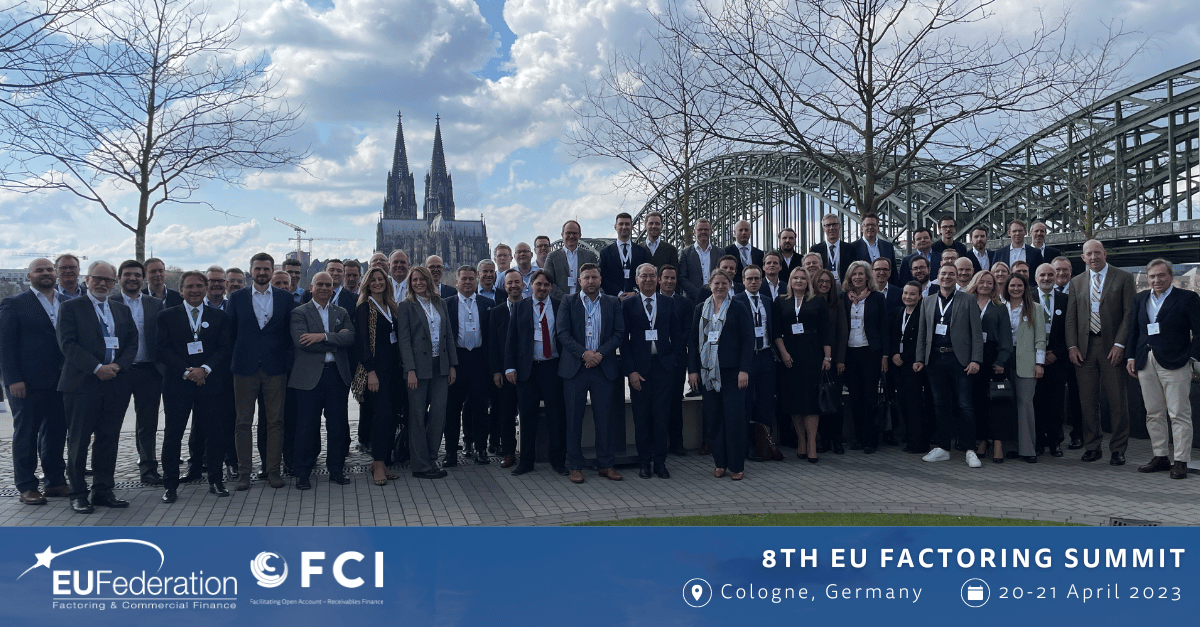

On 20 and 21 April, EUF & FCI hosted the 8th EU Factoring Summit in Cologne, Germany. This eighth Summit provided a unique opportunity for Industry Leaders to network and address topics that matter to the Factoring Industry. The programme addressed the latest updates and promoted the impact of the Factoring and Commercial Finance Industry in Europe. Due to the disruptions in Cologne from the strikes, the team provided participants who could not attend a way to connect online. All welcomed this last-minute shift to hybrid, ensuring all who registered were included.

EUF Chairman, Mr. Fausto Galmarini, opened the Summit as he welcomed everyone to the Summit, highlighting what participants could expect over the two days. Following this, participants heard from Prof. Dr. Thomas Hartmann-Wendels from the University of Cologne as he welcomed everyone to Germany. Mrs. Magdalena Ciechomska-Barczak, Chairwoman of the EUF Economic and Statistics Committee, shared the Preliminary Statistics and Figures for the Factoring Industry in Europe in 2022. She highlighted that the European Factoring Turnover in 2022 increased by 19% compared to 2021 and expressed her 2023 perspectives where the industry will see further growth in turnover, clients, credit risk, non-recourse factoring and further enhancement in digitalisation. Mr. Michael Menke, Member of the Deutscher Factoring Verband e.V. (DFV) Board, presented an update on the Factoring market in Germany.

Participants got to hear from CBI Managing Director, Mrs. Liliana Fratini Passi, as she shared a presentation on e-invoicing, PSD Revision and Future EU Initiatives on Open Finance. Following on from this, Mr. Diego Tavecchia, Chairman of the EUF PRC Committee, and Mrs. Magdalena Wessel, Chairwoman of the EUF Legal Committee, shared reports from the relative Committees, focussing on inter alia developments in the areas of supervisory harmonisation, late payments and default as well as the EU-wide implementation of Basel III including credit insurance as credit risk mitigation techniques. The Gold sponsors then presented each of their companies; CODIX was presented by Mr. Philipp Schmindinger, followed by COMARCH, presented by Mr Karol Lezczynski. Those in attendance were invited to a Networking dinner at Fruh Am Dom.

Day two, 21 April, opened with a presentation on the EU Banking Sector Asset Quality & Market Developments in Non- Performing Loans (NPL) by Mr. Gaetano Chionsini, the Head of Statistics at the EBA. Mr. Fausto Galmarini then chaired the panel discussion on Sustainability and ESG, featuring Mr. Dirk Hagener (Atradius), Mr. Wolfgang Reiser (BNP Paribas Factor GmbH), Mr. Christian Stoffel (Coface), and Mr. Guglielmo Santella (Allianz Trade) who shared their views on this hot topic. Mr. Roberto Zavatta, EU Commission Consultant, shared an update virtually on the EU Commission highlighting the Late Payment Directive Revision’s Impact on Corporate Sustainability.

Mr. Vincenzo Farina, EUF Coordinator, began the second half of the day as he enlightened participants on Mass Media, Financial Regulation and CRR Reform. Following this, Mr. Luca Gelsomino, Academic Director at the Supply Chain Finance Community, presented on the Sustainable Supply Chain Finance Opportunity. Next, Mr. Peter Mulroy, FCI Secretary General, chaired a panel discussion featuring Mr. Kevin Day (Lendscape), Mr. Mikko Malminen (OP Corporate Bank), and Mr. Aurélien Viry (Société Générale Factoring). The panel shared their views on where the industry will be by 2023, sharing the significant changes they see coming in the industry’s legal and regulatory landscape, what the future of e-invoicing and digitalisation in factoring will look like, how recent fraud cases are shaping the future for SCF in the EU, what the impact of the Russian-Ukrainian war will do to the EU and how much longer they see the interest rates increase and what the outcome will be.

The Summit was closed off with remarks by the chair of FCI, Ms. Daniela Bonzanini. She shared insights on the industry and what FCI is doing to promote the industry and stated: “The factoring industry is doing extremely well, global volume increased by 13.5% in 2021. The 2022 official statistics are not yet available however thanks to some preliminary indicators the same positive trend is estimated”. EUF Chairman, Mr. Fausto Galmarini, stated: "EUF is very satisfied for the results of year 2022 with a growth in turn over higher than 19%. Now the European factoring market represents more than two thirds of the worldwide market. Factoring has an important role in the European real economy with a GDP penetration higher than 12% and can solve all the problems connected with the late payment of the receivables but can do even more if the regulatory framework recognises its peculiarity in net working capital management and its low credit risk level".