Press release: Year of spectacular growth-2022 factoring figures

Brussels, 25 May 2023

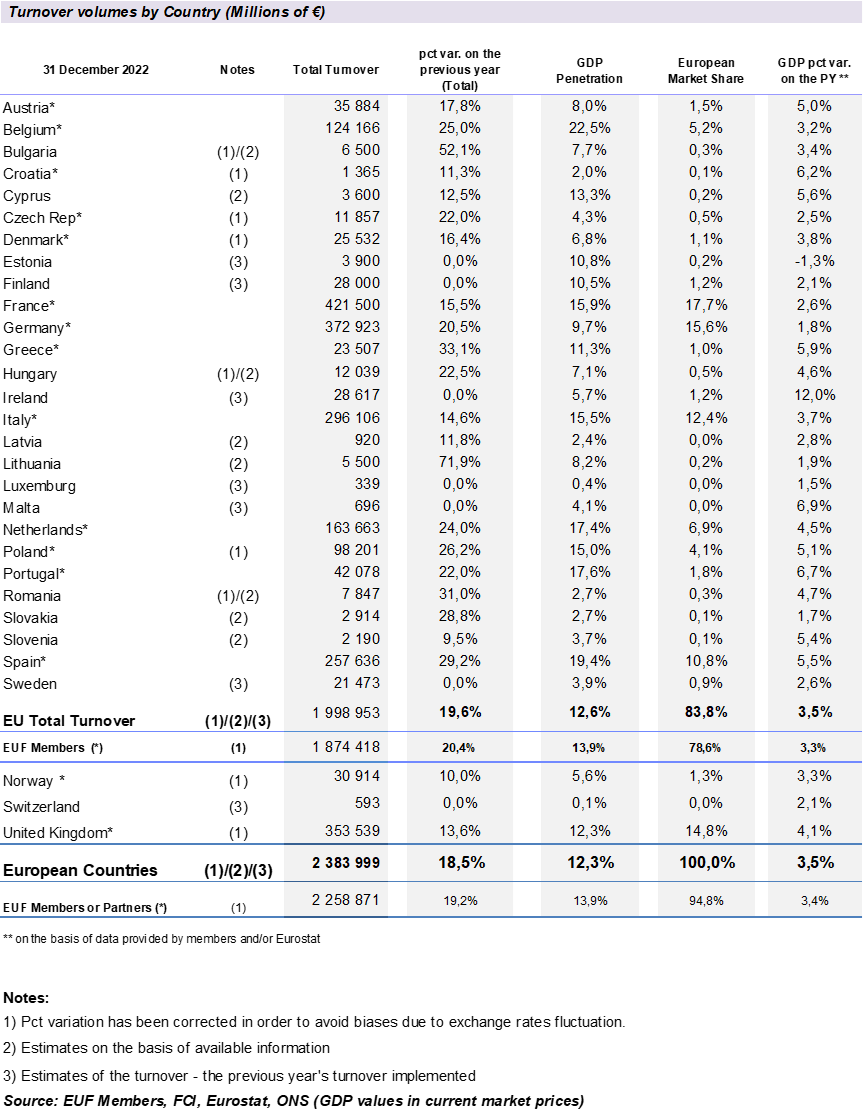

After the strong recovery in 2021, following the decrease of 2020 due to the pandemic, 2022 has shown a significant growth of almost 19%[1] year on year. As a result, total European factoring turnover reached 2,38 trillion € compared to 2,0 trillion € in 2021. Factoring turnover figures for the European market have been collated by EUF Economic and Statistic Committee thanks to the information received from EUF members.

The compounded average growth rate over the last 6 years reached 8,2% for the turnover of the European factoring industry. According to information received, the spectacular performance in 2022 was due, not only from the positive dynamics of the European economy, inflation, effect of Ukraine war – especially strong in Eastern European countries, but also from a better perception of factoring as a one of the best working capital financing products.

Almost all of the European turnover was done by EUF members and partners – 94,8% of the market, and according to EUF estimations 92% of turnover was performed by Banks or bank owned companies.

The concentration on the European factoring market in 2022 remained high at 71,4%, but it was slightly lower than in 2021 – with 72%. The leader of the EU market in 2022 was France with 18% of the market, the next were: Germany with 16%, UK 15%, Italy 12% and Spain 11% of market share.

There were 8 EUF member countries which had yearly factoring turnover dynamics higher than 20% and it included: Greece – 33% growth y/y, Spain – 29%, Poland – 26%, Belgium 25%, the Netherlands – 24%, Czech Republic and Portugal-22% and Germany – 21%. Not a single EUF member country had yearly growth ratio lower than 10% in 2022.

Thanks to the performance of the factoring turnover, this year’s GDP penetration ratio was higher than last year at 12,3% compared to 11,4%[2] in 2021. And consequently, the growth of the factoring turnover was real because it was much higher than the sum of European GDP increase and inflation rate. This is a clear sign of the growing importance of this type of working capital financing.

The dominant type of factoring in 2022 was still domestic, representing 78% of total turnover, compared to 77% back in 2021.

In 2022 for the 4th year in a row, non-recourse factoring was at a higher level than recourse, representing 53% of total turnover, the same structure was also seen in 2021. This means debtor risk coverage in 2022 was as much of an important issue as it has been over the last 3 years.

In conclusion, data collected by the EU Federation for Factoring and Commercial Finance for 2022, confirms that factoring market is continuously and dynamically growing even though it is perceived as mature in the majority of European countries. Such strong growth in 2022 can indicate that factoring is appreciated by clients as a reliable source of funding, which provides additional value, as debtor risk assessment and coverage, which is especially critical when there is uncertainty on the market observed.

Mr Fausto Galmarini, Chairman of the EUF, commented: “EUF is very satisfied of the results from 2022 with a significant growth in turn over. Now, the European factoring market represents more than two thirds of the worldwide market.

Factoring has an important role in the European real economy as demonstrated by the continuous increase of GDP penetration rate, now higher than 12%. It can solve all the problems connected with the late payment of the receivables but can contribute even more to the development of the real economy, if the regulatory framework recognises its peculiarity in net working capital management and its low credit risk level".

[1] Pct variations has been corrected in order to avoid biases due to exchange rate fluctuation

[2] Previous year’s ratio has been corrected in order to avoid biases due to exchange rate fluctuation

Table 1. Factoring turnover by country in 2022