Press Release: Strong recovery of factoring after pandemic decrease– 2021 figures

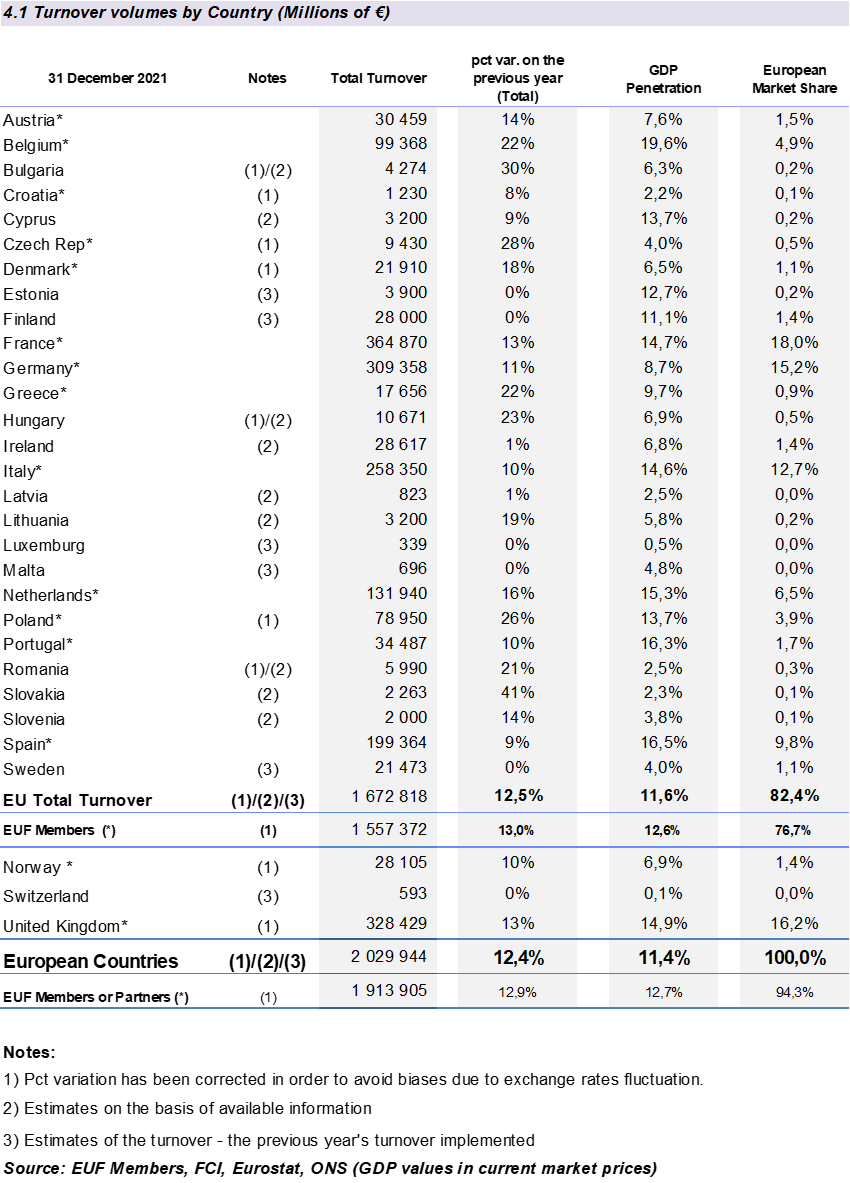

After the global pandemic it was difficult to project when and how the market would recover the lost volumes following the dramatic decline in GDP. But if we look at the data collated by the EUF Economic and Statistic Committee for 2021 we can ascertain the strong performance of the factoring market with a turn over growth of 12% compared to the previous year. The overall volume reached 2,0 trillion € comparing to 1,8 trillion € in 2020 and 23% of it is made by international factoring. The European factoring market is the most developed in the world, accounting two thirds of the worldwide turn over and these figures show how factoring is appreciated by the businesses as an important financial support also in times of crisis.

Such volume, even higher than the level reached in 2019, indicates a brilliant recovery after the dramatic decrease of 2020 caused by pandemic. Despite the last years’ drop, the compound average growth rate of the European factoring turnover in the past 6 years equals 6,2%.

According to the information received from the EUF members and partners, return on the growth path was possible thanks to the rebound of the European economy, inflation (especially in the second half of the year), surging prices of raw materials, shipping costs, energy etc. and, far broader among the businesses, perception of factoring as a widely accepted working capital financing product, particularly important in times of uncertainty as Factors can offer coverage on debtors by means of non recourse assignments.

The main part of the European turnover was done by the EUF members with 94,3%, and according to some EUF estimations, the majority of turnover is done by Banks or financial intermediaries owned by Banks with over 95%.

France, United Kingdom, Germany, Italy and Spain are always the top five countries but United Kingdom returned, after a year of being no.3, at vice leader’s position of the European factoring market.

The speed of recovery and the dynamic trend after post covid crisis was not the same in the EUF members and partners countries. In fact four EUF member countries had a turn over growth higher than 20% (Czech Republic 28%, Poland 26%, Greece and Belgium 22%) and, on the other side, two EUF member countries had a growth lower than 10% (Spain 9%, Croatia 8%).

Thank to the increase of factoring turnover, in 2021 the GDP penetration ratio was higher than the last year (11,4% comparing to 10,6% in 2020). It’s important to underline that the growth of factoring turnover was much higher (over 2 times) than the European GDP increase (in the EUF members and partners countries it was about 5,4% in 2021).

Mr Fausto Galmarini, Chairman of the EUF, noted: "The global pandemic shook the world in 2020 and continues to affect all the countries. However, the data collated by the EUF shows the resilience of our industry that could recover the volumes lost in 2020 and in some areas even exceed the turn over reached in the pre-pandemic period. This news gives hope to our industry and once again shows how factoring can support the real economy effectively also in difficult times of crisis. We have more than 264.000 active clients and at the end of 2021 the estimated amount of funds made available was over 274 bn euro (12% higher than in 2020), secured by receivables valued at 354 bn euro (increase by 12% y/y) and 6% higher than in pre pandemic 2019”.

In conclusion, data collected by the EU Federation for Factoring and Commercial Finance for 2021 confirm that the trend of factoring turnover is only partially correlated to the European macro-economic scenario: as noted above, in 2021 the volume growth was much higher than the increase of GDP and inflation together.

It indicates that factoring is more often perceived by the entrepreneurs as a reliable source of funding which provides, apart from an immediate payment, also additional values such as debtor rating and debtor risk coverage (in case of non-recourse factoring), which are appreciated by the clients especially in times of uncertainty.