Press release: Still on the growth path - 2023 factoring figures

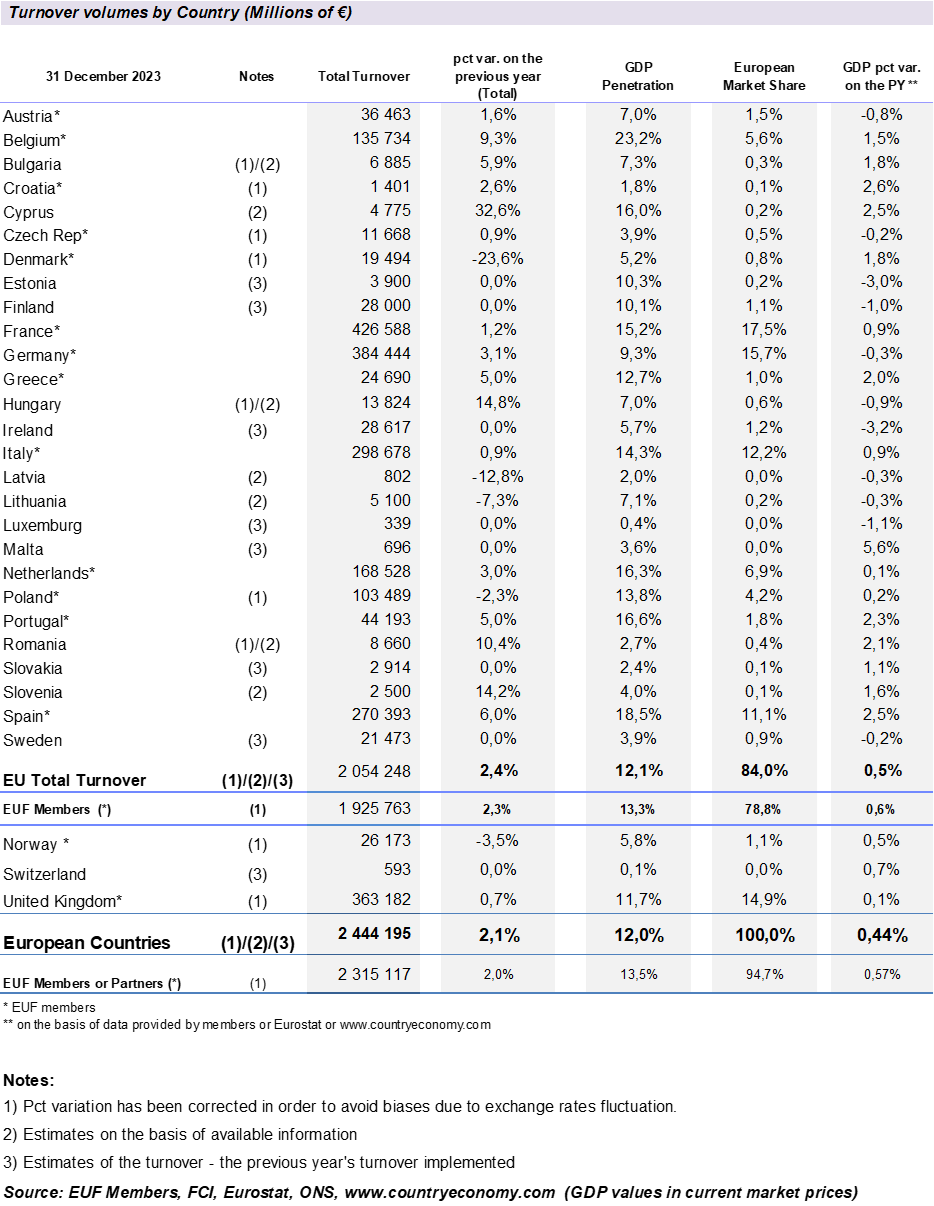

According to the latest figures, the European factoring industry experienced continuous growth in 2023, but at a slower rate compared to previous years. The total factoring turnover for European countries reached 2 trillion 44 billion euro, with a year-on-year growth rate of 2,1%. While this growth rate is among the lowest recorded by the EUF since data collection began, it is a sign of a stabilization in the factoring growth trend after several years of double-digit growth rates. But compound average growth rate of European factoring turnover calculated for last 6 years was at high level of 7,2%. These figures unequivocally demonstrate the thriving state of the European factoring industry and its potential for continued growth in the future.

According to information received from EUF members and partners, slowdown of factoring growth in 2023 was caused by:

- decrease of EU GDP growth,

- higher base rates in few countries, what caused shift from factoring facility to cheaper sources of funding,

- over liquidity in some sectors due to previous profitable years,

- decrease of consumer demand due to inflation and

- ceasing collaboration with clients with worsening financial situation.

Graph 1. Factoring turnover 2017-2023 (€T)

Similarly as it was in previous years, also in 2023 growth of factoring turnover was higher than European GDP yearly increase.

In 2023 average funds granted per client were almost 3% lower than in 2022 and reached 1,0M EUR. It was caused by parallel decrease in amount of advances together with increase in number of clients. The average turnover per client was higher by 2% than in 2022 and reached 8,0M €, due to the overall growth of factoring turnover year on year.

Estimated number of European active clients in 2023 reached almost 304k, and it was the highest level observed. Increase in clients number can suggests that entrepreneurs, in times of still high economic unpredictability were focused on obtaining additional sources of funding which can provide them also additional benefits- sa. risk coverage and debtor management.

In conclusion, data shows that factoring is already mature market in majority of European countries, so further growth won’t be as spectacular as it was observed in last few years. But sustainable growth in turnover together with continuous growth in clients number are signs of factoring market return on its standard, pre-pandemic growth path.

Commenting on the announcement, FCI chairman, Fausto Galmarini said: “It's been an interesting journey in the world of factoring! After two years of double-digit growth in turn-over, in 2023 we were expecting a slow-down. The EU GDP took a hit, dropping from 3.5% in 2022 to 0.4% and the European Central Bank adopted some strict policies to get inflation under control, which led to lending rates skyrocketing. Plus, the macro economic scenario was impacted by some major conflicts happening between Russia and Ukraine, and Israel and Palestine. But, even with all of that going on, the European factoring market is still strong, making up a whopping 66% of the world market. The factoring industry is playing a crucial role in the European real economy, with a stable 12% penetration rate in the GDP. In 2023 International factoring, accounting for 22% of the total turnover, has held its position steady. Non-recourse factoring, with a share of 53%, continues to dominate the market, demonstrating its adaptability to meet the clients' needs and address the debtors' risk.

In 2024 we expect a turn-over growth slightly better than 2023 thanks to the recovery of the EU GDP, the reduction foreseen in the interest rates for the dropping of the inflation, even in a complex scenario because of the conflicts between Ukraine and Russia and Israel and Palestine that are far from finding closure."

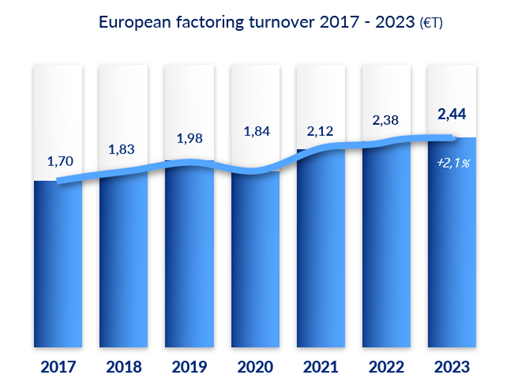

Enclosure: Factoring turnover by country in 2023

ENDS 15.05.2024

Notes to Editors

The EUF is the Representative Body for the Factoring and Commercial Finance Industry in the EU. It comprises national and international industry associations that are active in the region. The EUF seeks to engage with Government and legislators to enhance the availability of finance to business, with a particular emphasis on the SME community. The EUF acts as a platform between the Factoring and Commercial Finance Industry and key legislative decision makers across Europe, bringing together national experts to speak with one voice.

For more information, see our website: www.euf.eu.com

Contact: info@euf.eu.com

Table 1. Factoring turnover by country in 2023