Press Release: First decrease in factoring turnover in 11 years – 2020 EU figures

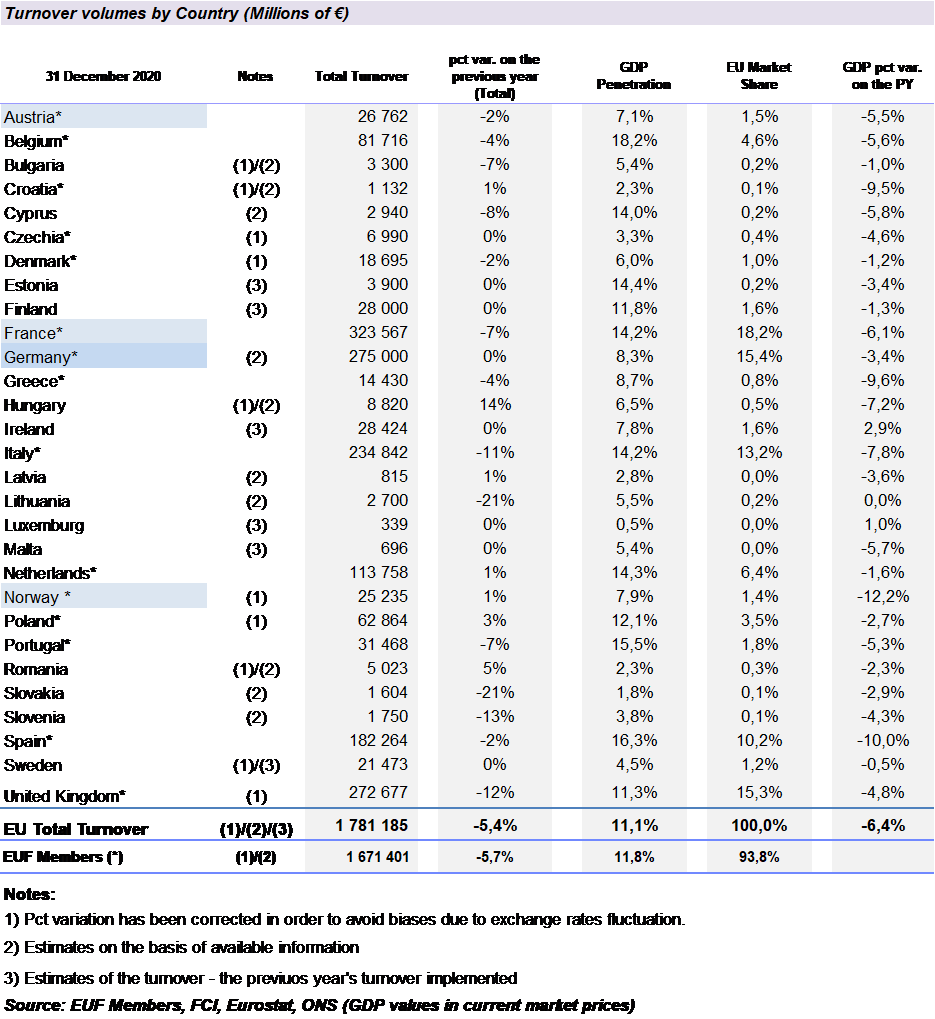

The provisional data collated by the EU Federation for the Factoring and Commercial Finance Industry (EUF) shows that in 2020 factoring and commercial finance volumes in the EU decrease of 5,4% in factoring turnover. It is the first time in 11 years. Total factoring turnover in the EU reached 1.78 trillion € comparing to 1.91 trillion € in 2019. Country members organizations indicate that the drop was mainly an effect of a lockdown. 79% of this represented domestic business and the balance international.

This year’s GDP penetration ratio was slightly lower than last year’s (11.1% compared to 11.3% in 2019), and there were again wide variations between countries. The lowest GDP penetration ratio was in Luxemburg (0,5%) and the highest in Belgium (18%). The results of EU GDP penetration ratio dynamics, compared to previous years’ results, show that a decrease in factoring turnover was in line with the decrease of the GDP of EU countries.

2020 was the following year in a row when a share of non-recourse factoring in total turnover grew again. It exceeded 53% of total turnover (52% in 2019 and 50% in 2018). In 2020 both factoring types decreased, but non-recourse was less affected – when recourse factoring turnover fell by 10% y/y, non-recourse only reduced by 4% y/y. It confirms that risk coverage offered with non-recourse factoring is highly appreciated by companies, especially in times of uncertainty.

The estimated amount of funds made available to 259,000 European businesses in 2020 was 245 bn euro, 11% lower than in 2019. It may suggest that factoring companies, in times of economic uncertainty, reduced the number of clients with poor financial condition or belonging to the industries. It may also be the result of some state supporting measures to businesses to cope with the crisis that reduce the need of funding.

Mrs Françoise Palle-Guillabert, Chairman of the EUF, noted: "The international Covid-19 pandemic has shaken the world in 2020 and continues to affect all of us. The data collated by the EUF show the significant impact on the activity of factors of the sudden shutdown of the economy with the lockdowns and of the absence of invoices to finance. The coming months will be decisive and the EUF is committed to supporting economic recovery”.

Data has been adjusted to ensure that currency exchange rate fluctuations do not distort the results.

For more information and full data analysis: