Press Release: First slowdown after pandemic in factoring figures– 2024 statistics

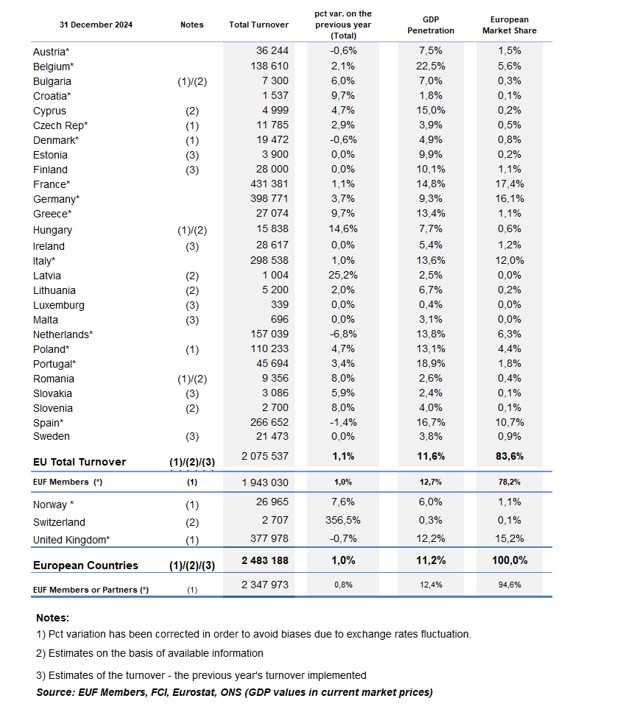

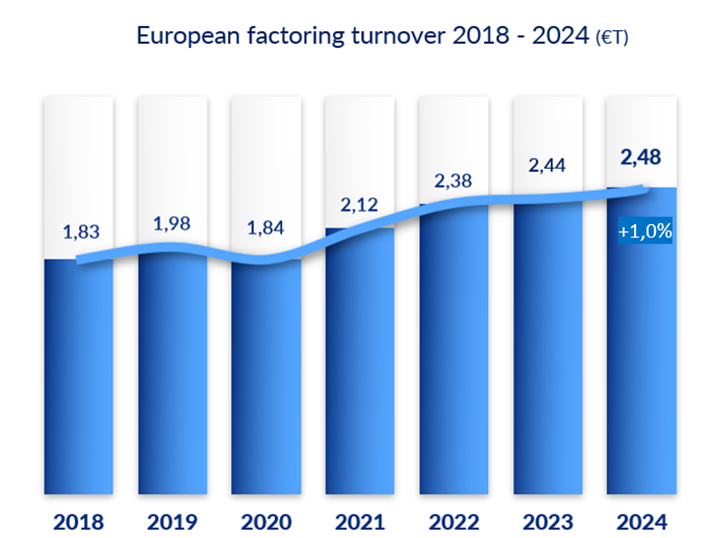

According to the latest figures, the European factoring industry slowdown of growth in 2024. The total factoring turnover for European countries reached 2 trillion 48 billion euro, with a year-on-year growth rate of 1,0%. This growth rate is the lowest recorded by the EUF since data collection started. Compound average growth rate of European factoring turnover calculated for last 6 years was decreased to 5,4%. Although the expansion of factoring market stalled in 2024, it is well positioned for rebound as economic growth resumes and market uncertainty diminishes, when GDP will rise and it should boost business activity and demand for short-term financing solutions.

According to information received from EUF members and partners, slowdown of factoring growth in 2024 was caused by:

- slower EU GDP growth,

- higher base rates in few countries, what caused shift from factoring facility to cheaper sources of funding,

- still visible over liquidity in some sectors due to previous profitable years – especially in large companies,

- decrease of consumer demand due to inflation and geopolitical uncertainty,

- ceasing collaboration with clients with worsening financial situation,

- regulatory and compliance pressure – stricter AML and KYC regulations slowed down onboarding of new clients and

- technological disruption and fintech competition – growth in alternative financing platforms, targeting SMEs.

Graph 1. Factoring turnover 2018-2024 (€T)

For the first time we observe that the growth of factoring market in Europe has matched, rather than exceeded, the EU GDP growth. While factoring has traditionally outpaced GDP growth due to its strong positive correlation with economic activity and demand for working capital, this alignment in 2024 may be attributed to mentioned above persistent uncertainty, tighter financial conditions and cautious spending behaviour among SMEs, which have historically driven factoring volumes.

In 2024 average funds granted per client were almost 4% higher than in 2023 and reached 1,05M EUR. It was caused by parallel increase in amount of advances by 4% together with slow decrease in number of clients (-0,6%). The average turnover per client was higher by 2% than in 2023 and reached 8,2M €, due to the growth of factoring turnover year on year and mentioned before decrease in clients number.

Estimated number of European active clients in 2024 reached almost 302k, and it was -1% less than in 2023. That drop in clients number was caused mainly by two countries, whose reported 5% decrease– it was France and UK. Slight decrease was also reported in Austria, but all other countries have reported growth in financing businesses.

In conclusion, despite the temporary slowdown in factoring growth observed in 2024, factoring remains a resilient and highly relevant financial tool for European SMEs. Its feature to adapt to operational specific and seasonal needs of businesses makes it uniquely suited to support day-to-day liquidity management. As confidence gradually returns and economic activity accelerates, factoring is likely to regain its growth trajectory. Its deep integration into the real economy, personalized approach to clients needs give it a clear advantage in a market increasingly seeking reliability, tailored financing and long term partnership. Because factoring is not just a financing tool, but it is a comprehensive solution for sustainable business growth.

Commenting on the announcement, EUF chairman, Fausto Galmarini said: "Reading the statitistics well represented by Magda we can observe that also in 2024 the European Factoring market is the most developed in the world, with two thirds of the global volumes, even if we are facing the first slowdown after pandemic. There are many reasons that led to this trend: the slower EU GDP, the crisis in some manufactoring sectors, the impact of the escalation of the conflicts between Russia and UKraine and in the countries of the Middle East, the decrease on consumer demand due to the inflation rate and finally the regulatory and compliance pressure. But on the other side we can be satisfied for two important key indicators: the GDP penetration, over 11,2%, and the amount of the advances granted to the clients that grew above 4%.

This is a confirmation of the increasingly important role of factoring in real economy.

We are sure that in year 2025 the trend will be better, in relation to the expected rebound of EU GDP and the need of more funding of the businesses."

Table 1. Factoring turnover by country in 2024